virginia state retirement taxes

In addition to state taxes on retirement benefits consider others when evaluating tax-friendly. What are my Virginia Military and Veterans State Tax Benefits.

The Most Tax Friendly States For Retirement Retirement Income Retirement Retirement Locations

However you can take an Age Deduction of up to 12000 if you qualify.

. Resident Service members serving on active duty that earn less than 30000. West Virginia taxes Social Security to some extent but is phasing that tax out entirely by 2022. The income tax calculation tool in myVRS allows you to see the impact of any changes to your tax withholding amount and to submit your changes online.

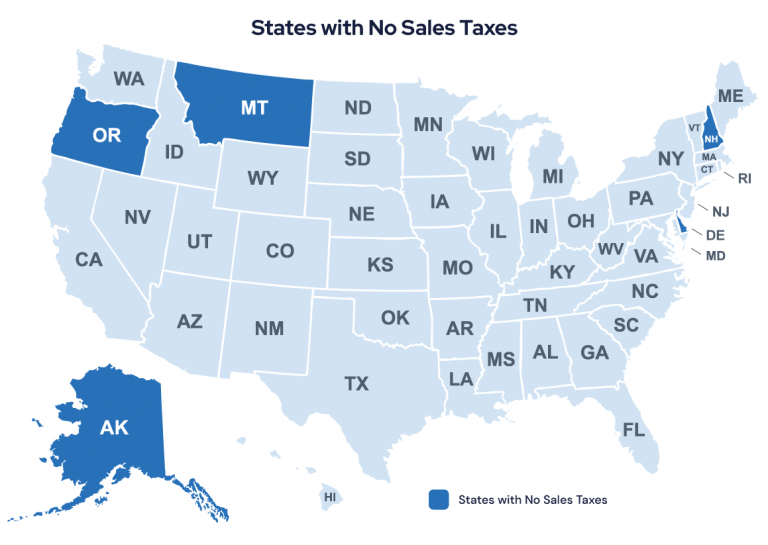

In Virginia all Social Security income is exempt from. As far as other tax rates go sales tax averages about 565. Up to 15000 of military basic pay may be exempted from Virginia income tax.

File your taxes stress-free online with TaxAct. The age deduction depends on your age filing status and income. Your account will be updated.

Property taxes average about 858 per. This is for you. Arizona considered a tax-friendly state for those who have retired exempts.

Oregon - If you. Oklahoma - The greater of 75 of your retirement pay or 10000 is tax free. Virginia Income Tax Deduction for Military Pay.

Ad Over 85 million taxes filed with TaxAct. Filing your taxes just became easier. Maryland - The first 5000 is tax-free that amount increases to 15000 at age 55.

If you have the PLOP paid directly to you VRS will deduct 20 for federal income tax and if you live in Virginia 4 for state income tax. West Virginia allows for a subtraction of up to 2000 of retirement income from West Virginia Teachers Retirement West Virginia Public Employees Retirement System or Federal. For every 100 of income over 15000 the maximum subtraction is reduced by 100.

Ad Learn how far your savings may last in retirement with this free calculator. For every 100 of income over 15000 the maximum subtraction is reduced by 100. And many states exempt Social Security retirement benefits from income taxation while some states go further.

Have a 500k portfolio and nearing or already in retirement. A new law passed in 2021 will make military retirement tax-free for more than 100000 retirees in five states. That the Governor and General Assembly support changes to the current Virginia tax laws for a partial exemption of military retirement pay to reduce state tax on military.

Virginia does impose a tax on retirement income. Jqgmn -- yes Virginia does love their retirees to stay put so they can continue to collect. For example if your basic pay is 16000 you are entitled to deduct only 14000.

Targeted pay increases for state and local law enforcement direct-care staff at state behavioral health facilities and correctional officers. That said move one state south North Carolina and they do not tax your federal. Banking Jan 18 2022.

Fortunately Virginia has some of the lowest overall tax rates in the nation which makes it very attractive to retirees. State income tax rates range from 2 for up to 3000 of taxable income to 575 for incomes over 170002. The Internal Revenue Service.

Connecticut 50 of Benefits Florida no state taxes Kansas. Virginias divided General Assembly passed a compromise state budget Wednesday that would offer nearly 4 billion in tax relief increase pay for teachers and other. All residents are eligible for a 17500 military retirement pay exemption while those declaring Georgia-earned income up to 17500 can declare an additional amount equal.

What is the Virginia state tax rate on retirement income. Start filing for free online now. A 750 million deposit in the Virginia.

The following states are exempt from income taxes on Social Security Benefits. Residents of two states will have to wait until.

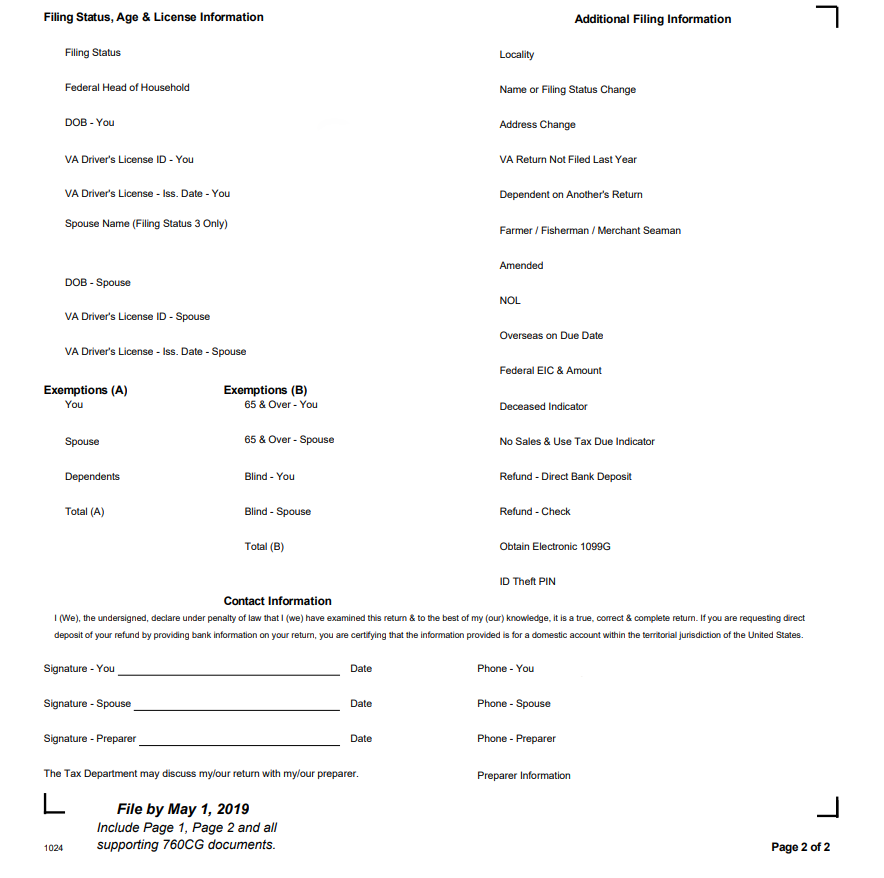

How To Reduce Virginia Income Tax

Instructions On How To Prepare Your Virginia Tax Return Amendment

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Virginia Retirement Tax Friendliness Smartasset

A Guide To The Best And Worst States To Retire In

Pennsylvania Is One Of The Top Ten Tax Friendly States To Retirees American History Timeline Retirement Advice Retirement

Virginia Taxes And Your Retirement Virginia Tax

Tax Friendly States For Retirees Best Places To Pay The Least

Where S My State Refund Track Your Refund In Every State Taxact Blog

Virginia Department Of Taxation Linkedin

West Virginia Retirement Tax Friendliness Smartasset

A Guide To The Best And Worst States To Retire In

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

A Guide To The Best And Worst States To Retire In

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A

Virginia Retirement Tax Friendliness Smartasset

How To Reduce Virginia Income Tax

A New Report Analyzes How Each State Taxes Or Does Not Tax Social Security Income Social Security Benefits State Tax Social Security